Every year, GOBankingRates conducts a survey to determine how much money the average adult American has in savings. Sadly, each one has shown the same thing: a majority (58 percent) have less than $1,000 socked away. If this is you, one decent-sized emergency can put you under.

For example, in late 2018, the Detroit Free Press published an article indicating that, due to the amount of technology being included in cars nowadays, it’s not unheard of to have a repair bill in the tens of thousands if you’re involved in accident that causes damage where the tech is stored.

Health policy journalist Sarah Kliff adds that an emergency visit to the hospital isn’t much better. In fact, after reviewing 1,182 medical bills, she noticed that some healthcare facilities charge $3,000 or more just to walk through their doors. And that’s in addition to the high drug prices you’re likely to pay (such as $238 for generic eyedrops or $465 for a pregnancy test).

This can lead to a lot of stress in your life, making you feel like the only way you’re ever going to have a comfortably stocked bank account is to work a second or even a third job. Certainly, you can do this if you want to, but here are a few other options to consider.

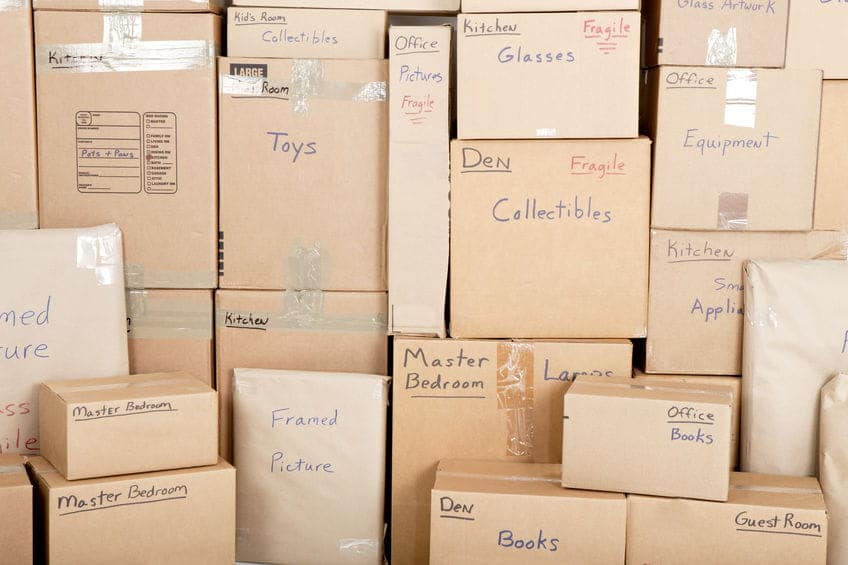

Sell Things You Don’t Use or Need

Chances are good that if you were to walk around your place right now, you could come up with a list of things you don’t really use or need. Why not sell them and put the profits in your savings account, giving you a greater peace of mind?

If they are smaller items and not worth much, hold a garage sale and get rid of them that way. For larger and/or more expensive pieces, such as furniture or vehicles, selling them on sites like eBay or Craigslist is often a better way to go.

Download a Rebate App

When you can get paid for doing your weekly grocery shopping or buying your loved one’s their birthday and Christmas presents, why wouldn’t you? With rebate apps, you can do exactly that and put a little bit of cash back into your pocket, or your savings account rather.

TheStreet.com shares that a few of the best cashback apps for 2019 are Ibotta, Drop, Ebates, and Shopkick. Each one has its own rules and requirements regarding what you have to do to get the cash back, so look them over closely to make sure you’re willing to take the actions that particular app demands.

Use Your Influence to Make Some Cash

Do you spend a lot of time on social media, enough so that you’ve built up a pretty decent following? If so, why not use your influence to make some side money by recommending products or services that you already use or believe in?

Some businesses are willing to pay a decent amount of commission to a social media influencer who will do a few promotions for them. Reach out to the companies that you wouldn’t mind encouraging your followers to buy from and see if they’d be willing to strike a deal.