Identifying your own risk tolerance allows you to make informed and strategic decisions when it comes to your investments. Your risk tolerance refers to your ability to withstand fluctuations in the market and your willingness to take on risk in pursuit of higher returns. Understanding it can help you determine what types of investments best suit your needs and goals. This will help you make smarter investment decisions and achieve your financial goals in the long run.

Types of Risk Tolerance

There are generally three types of risk tolerance to be aware of. It’s also important to note that your risk tolerance may fluctuate throughout your life depending on age, income, and established equity.

1. Conservative

Investors with a low tolerance for risk are often referred to as conservative investors. They prefer low-risk investments with a high degree of safety, such as bonds, certificates of deposit, and money market funds.

2. Moderate

Moderate investors are willing to accept some degree of risk in exchange for the potential for higher returns. They may invest in a mix of stocks, bonds, and mutual funds to achieve their investment goals.

3. Aggressive

Aggressive investors are willing to take on a high degree of risk in pursuit of higher returns. They may invest heavily in stocks, options, and other high-risk investments to maximize their potential returns. However, this approach can also result in significant losses if the market experiences a downturn.

Factors That Affect Risk Tolerance

Several factors can influence an individual’s risk tolerance. These include:

- Age: Younger people usually have a higher risk tolerance because they have more time to recover from potential losses — they can afford to take on more risk in pursuit of higher returns.

- Investment goals: Those with lofty short-term goals, like saving for a down payment on a house or car, may have a lower risk tolerance than those with long-term goals, like saving for retirement.

- Financial situation: People with a larger net worth or higher income may be more willing to take on risk than those with fewer financial resources.

- Investment experience: People who are experienced in the stock market may be more comfortable taking on risk.

- Personal preferences: A person’s comfort level with risk can also play a role in determining their risk tolerance. Regardless of a financial situation or investment goals, some people are just more risk-averse than others.

How To Identify Risk Tolerance

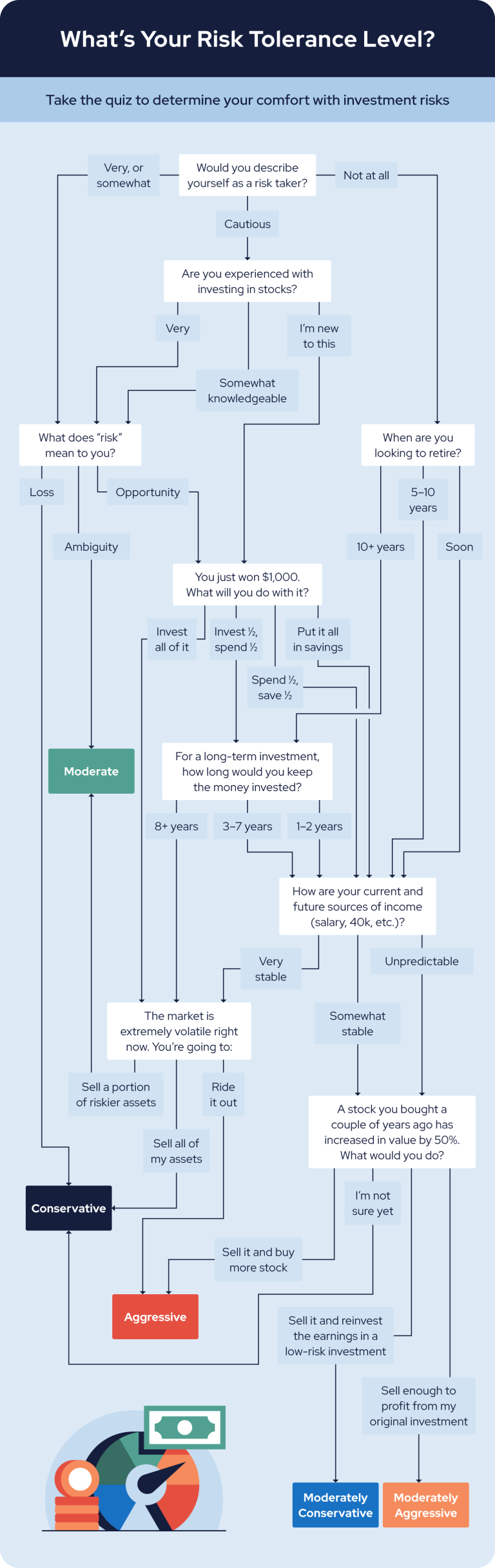

Now that you know the types of risk tolerance and the different factors that may affect it, it’s time to determine your risk tolerance with this flowchart. Understanding your risk tolerance is an important part of achieving your financial goals. Assessing your individual situation, goals, and comfort level with risk, can help you make informed and strategic investment decisions that are best suited to your needs. If you’re an aggressive, moderate, or conservative investor, investment options are available to help you achieve your goals.